ING Beneficiary Designation 2009-2025 free printable template

Show details

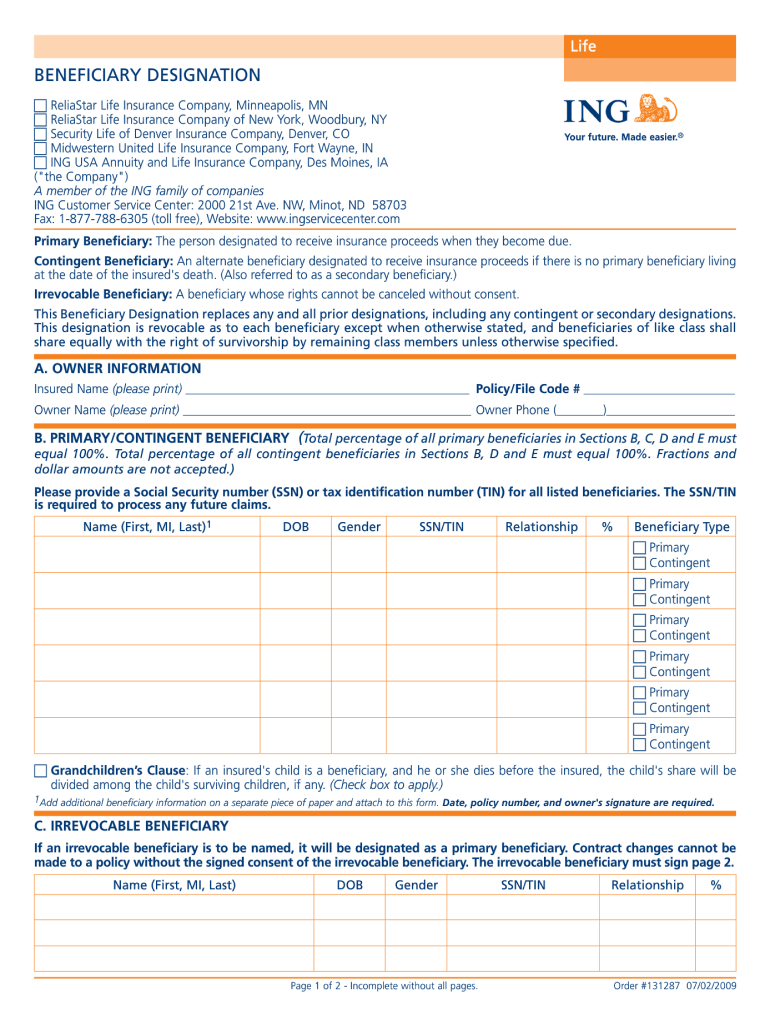

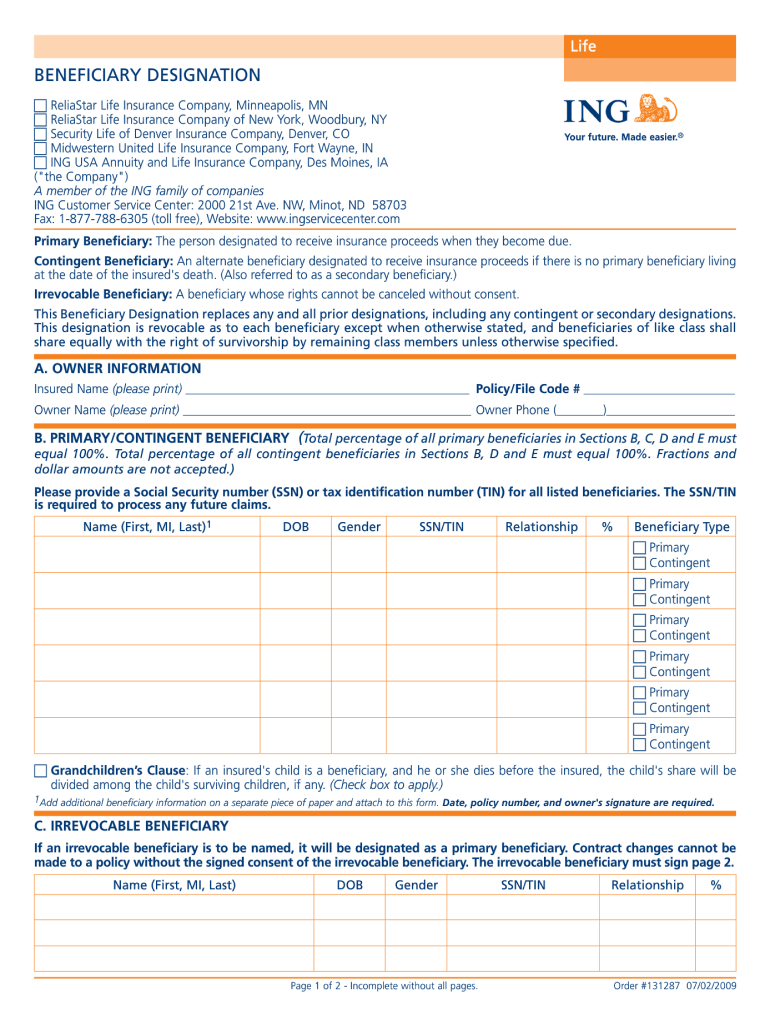

RESET FORM Life BENEFICIARY DESIGNATION ReliaStar Life Insurance Company Minneapolis MN Security Life of Denver Insurance Company Denver CO Midwestern United Life Insurance Company Fort Wayne IN ING USA Annuity and Life Insurance Company Des Moines IA the Company A member of the ING family of companies ING Customer Service Center 2000 21st Ave. NW Minot ND 58703 Fax 1-877-788-6305 toll free Website www. ingservicecenter. com Your future. Made easier. Primary Bene ciary The person designated...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign reliastar life insurance company forms

Edit your voya change of beneficiary form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reliastar life insurance beneficiary form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit voya life insurance beneficiary form online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit reliastar beneficiary designation form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out beneficiary designated ing form

How to fill out ING Beneficiary Designation

01

Gather necessary information, including the names and details of your beneficiaries.

02

Go to the ING Beneficiary Designation form on the ING website or contact your ING representative.

03

Fill out your personal information at the top of the form, including your account number.

04

List the beneficiaries' full names, relationships to you, and percentage of benefits each should receive.

05

Review the information to ensure accuracy.

06

Sign and date the form to validate it.

07

Submit the completed form to ING, either online or via mail.

Who needs ING Beneficiary Designation?

01

Individuals who have financial accounts with ING wishing to specify who receives their assets after their passing.

02

People planning their estate and wanting to ensure their heirs are clearly designated.

03

Clients who have specific preferences for asset distribution for retirement accounts, life insurance, or investment accounts.

Fill

reliastar forms online

: Try Risk Free

People Also Ask about reliastar life insurance change of beneficiary form

How do you fill out a beneficiary change form?

7:26 9:59 How to Complete the Beneficiary Change Form - YouTube YouTube Start of suggested clip End of suggested clip But you should contact the pensions and benefits office for the correct. Form. After you haveMoreBut you should contact the pensions and benefits office for the correct. Form. After you have completed this section all that's left is to sign your name and date. The form in the designated. Space.

How long does it take to change a beneficiary?

Beneficiary changes that occur in the last-minute are generally those applied in the days, weeks or months immediately before the death of the individual in question. In some cases, the policyholder's caretaker or relative alters the life insurance document either on their own or at the request of the insured.

What do you need to put someone as your beneficiary?

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

What is a change of beneficiary form?

Completing this form replaces your existing Beneficiary designations. This form must reflect all Beneficiaries, both Primary and Contingent, who should receive the proceeds of the policy(ies) listed below. • To name additional Beneficiaries, attach a separate page.

Can you change beneficiary at any time?

The beneficiary can be either revocable or irrevocable. A revocable beneficiary can be changed at any time. Once named, an irrevocable beneficiary cannot be changed without his or her consent. You can name as many beneficiaries as you want, subject to procedures set in the policy.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ing beneficiary print in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your beneficiary reliastar pdffiller and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit change of beneficary form straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing beneficiary ing form right away.

Can I edit voya life insurance forms on an iOS device?

Create, edit, and share reliastar beneficiary change form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is ING Beneficiary Designation?

ING Beneficiary Designation is a legal document that allows individuals to designate who will receive their benefits upon their death, such as insurance proceeds or retirement accounts, ensuring that their assets are distributed according to their wishes.

Who is required to file ING Beneficiary Designation?

Individuals who hold a policy, account, or retirement plan through ING, and wish to designate a beneficiary for those assets are required to file the ING Beneficiary Designation.

How to fill out ING Beneficiary Designation?

To fill out the ING Beneficiary Designation, you need to provide your personal information, the names and details of your chosen beneficiaries, and ensure that you sign and date the document to validate it.

What is the purpose of ING Beneficiary Designation?

The purpose of ING Beneficiary Designation is to specify who will receive your financial benefits after your death, thereby avoiding legal complications and ensuring that your wishes are honored.

What information must be reported on ING Beneficiary Designation?

The information that must be reported on ING Beneficiary Designation includes the policyholder's name, beneficiary names, social security numbers, relationship to the policyholder, and any percentages of the benefit to be allocated among multiple beneficiaries.

Fill out your ING Beneficiary Designation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voya Life Insurance Beneficiary Change is not the form you're looking for?Search for another form here.

Keywords relevant to beneficiary reliastar online

Related to life insurance beneficiary form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.