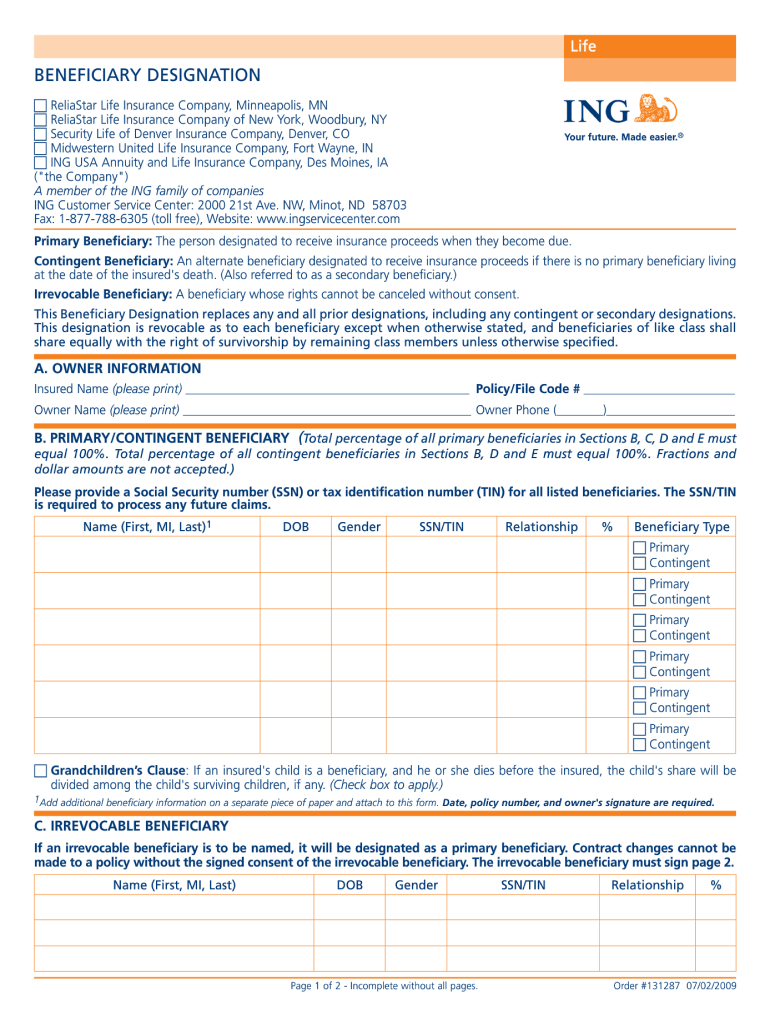

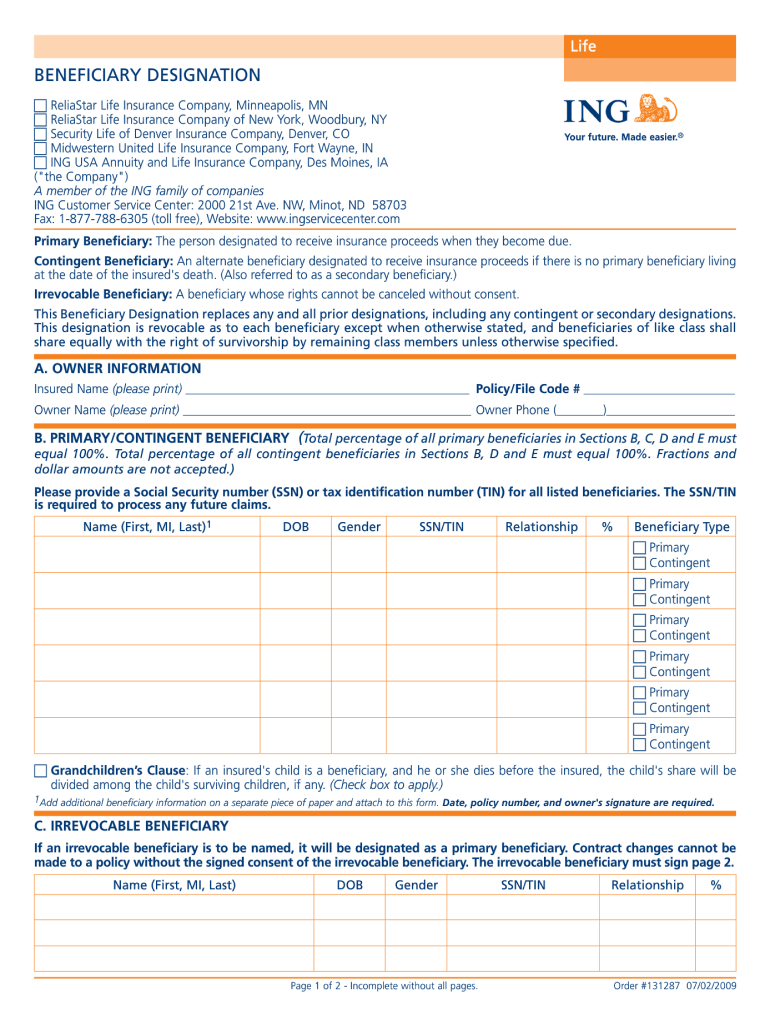

ING Beneficiary Designation 2009-2025 free printable template

Get, Create, Make and Sign reliastar life insurance company forms

How to edit beneficiary ing template online

How to fill out reliastar forms

How to fill out ING Beneficiary Designation

Who needs ING Beneficiary Designation?

Video instructions and help with filling out and completing beneficiary ing form

Instructions and Help about voya life insurance beneficiary form

And welcome back to how to find we are going to add interbank when officiate to SBI or a non SBI account to add as a beneficiary to SBI note down the information required to add the beneficiary to online SBI note that your mobile numbers should be registered with online SBI calm so that you receive one-time password login to online SBI dot-com using your username and password and click on profile and profile click on manage beneficiary it will ask you to input profile password input the password after that select interbank beneficiary here you input the name of beneficiary the account number and the account number then you can add the address of beneficiary you also need the IFC code which you can find from various websites available the IFC code is beneficiaries banks I have C code input the limit you want to have for this beneficiary select the IFC code input die of C code here accept the terms and condition click on submit button after that bank will send you an SMS on your mobile with one-time password after you receive the password click on approve tab select the approval beneficiary after that select the beneficiary name which you want to approve and input the high-security password as shown on your SMS typically it is a digital password click on approve after that you have successfully added the beneficiary note that this beneficiary will be available for use after four hours after you complete the process of adding the beneficiary bank sends two or three SMSes for one that activation is in process and second is for confirmation that beneficiary is being added this is a good security feature wherein you can know if anyone has not added a beneficiary by hacking into your bank account thank you for watching this video and have a good day

People Also Ask about voya change of beneficiary form

How do you fill out a beneficiary change form?

How long does it take to change a beneficiary?

What do you need to put someone as your beneficiary?

What is a change of beneficiary form?

Can you change beneficiary at any time?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my change of beneficary form in Gmail?

How do I edit reliastar life insurance beneficiary form straight from my smartphone?

Can I edit beneficiary ing on an iOS device?

What is ING Beneficiary Designation?

Who is required to file ING Beneficiary Designation?

How to fill out ING Beneficiary Designation?

What is the purpose of ING Beneficiary Designation?

What information must be reported on ING Beneficiary Designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.